When it comes to the valuation of a real estate, Invest for Excel® can be used by estimators to calculate using the DCF-method. Depending on the available data and the nature of the real estate, different calculation methods can be applied. For Single-family homes or condominium ownership there is the regular hedonic valuation. For objects which have a cash flow, such as Multi-family homes and commercial property, the DCF-Valuation method can be applied. There are several types of projects when a DCF-calculation should be used as basis for feasibility recommendations:

- Single real estate property

- Real estate portfolios

- Building plot / development areas

- Building lease

- New building construction

- Renovation / reconstruction

In the latest years, the importance of the Discounted Cash flow method for real estate valuation has grown. The current trends are leading towards larger, more complex international real estate portfolios, where the transparency across the market is not established yet. Investors and real estate estimators are trying to professionalize and to rationalize their investment process. Here, the regulatory framework of organizations and stakeholders contribute guidance for an aligned coordination within the industry. The trend in the valuation changes from a single object-based towards a connected analysis of synergies between several objects. Those include the measurement of the sensitivity analysis and the risk/return ratios. The lack of given standards for real estate professionals have led towards the progress of applying the DCF-method industry-wide.

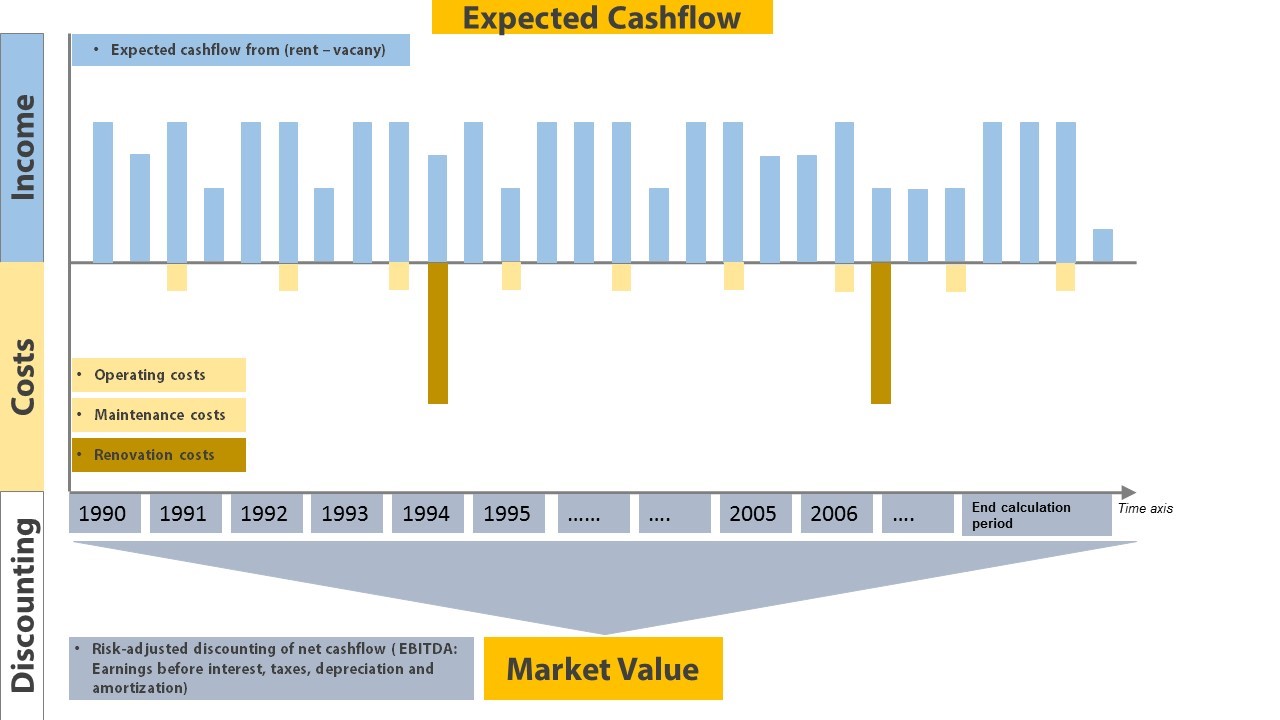

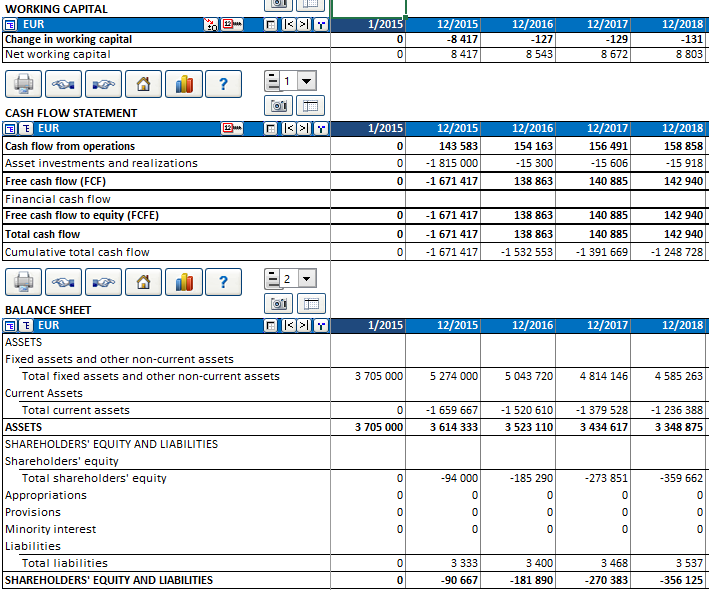

Question: If I want to sell my real estate property today, what market price will result for the property?

Answer: The market price is calculated by and reflects the present value of all future cash flows, discounted with a risk adjusted interest rate.

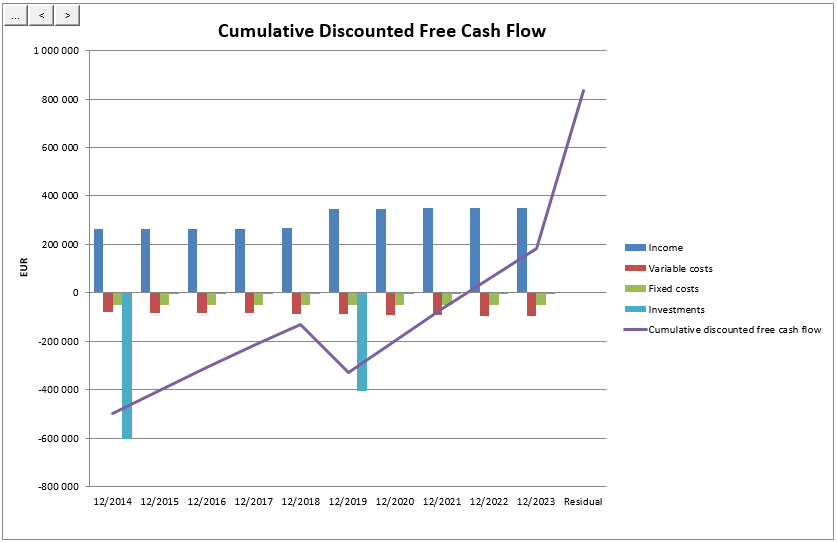

In Invest for Excel you are able to illustrate the development of the cumulative discounted free cash flow. It shows, how your rental object will perform within the given timeline and with the expected cash flows. The interception of the violet line and the 0-x axis marks the end of the payback period.

When looking at the cash flows, there are three types which are involved in a broad planning.

- The Operating cash flow consists out of the income minus the income loss, and the operating and maintenance costs.

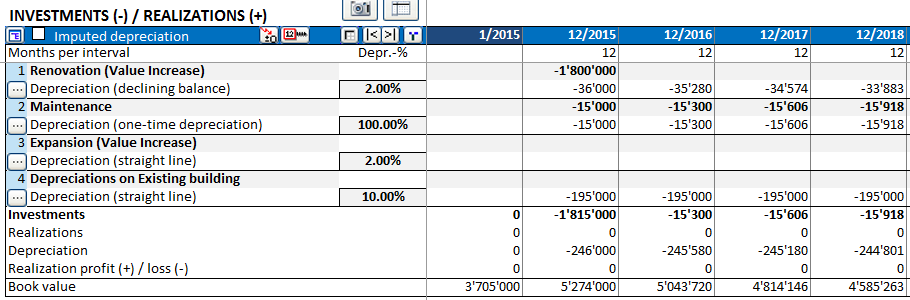

- The Investment cash flow consists of value increasing and reutilization investments. They are regarded as value enhancements.

- The Financing cash flow consists of the debt capital, mortgage, leverage and asset- / liability management. The financing cash flow is not appraisal relevant.

There are critical points and limitations for every valuation. A calculation can only be as good as the available data which is used for calculating it. It cannot reflect the future with 100% certainty, but it can be used to model future expectations. The DCF-method can only use objective numerical data, but subjective elements have also to be taken into account for a fair valuation. There is a risk-adjusted discount factor for the calculation, but this cannot reflect all the risk related to a certain property or object. Especially the DCF-method can leverage outcome effects by applying different concepts regarding the soft factors.

Calculating the future cash flows

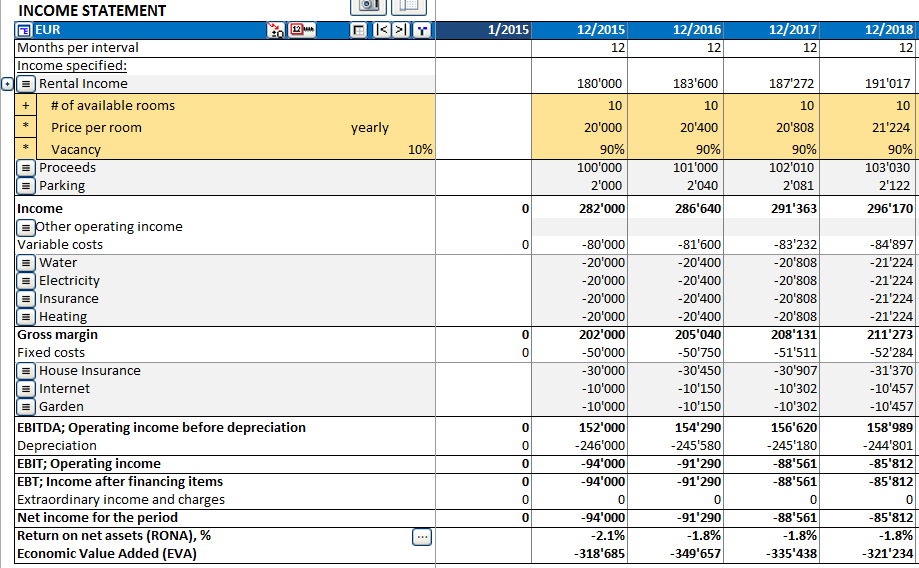

The valuation of the future cash flows are calculated step by step.

1. Determination of rental price potential and its development

2. Evaluation of expected vacancy of the real estate object

3. Determination of the expected operating costs

4. Planning of maintenance and renovation costs

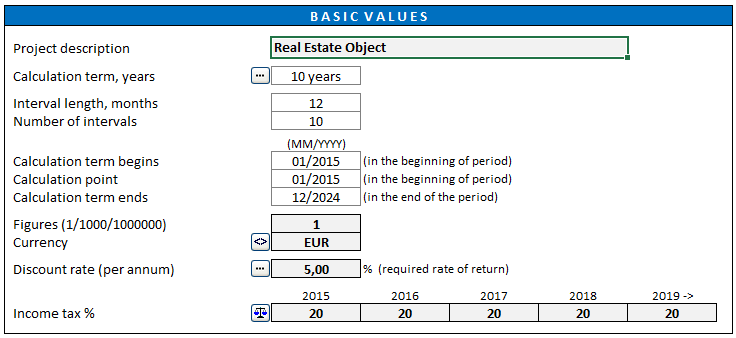

In Invest for Excel, the calculation steps could look as in the following examples (simplified):

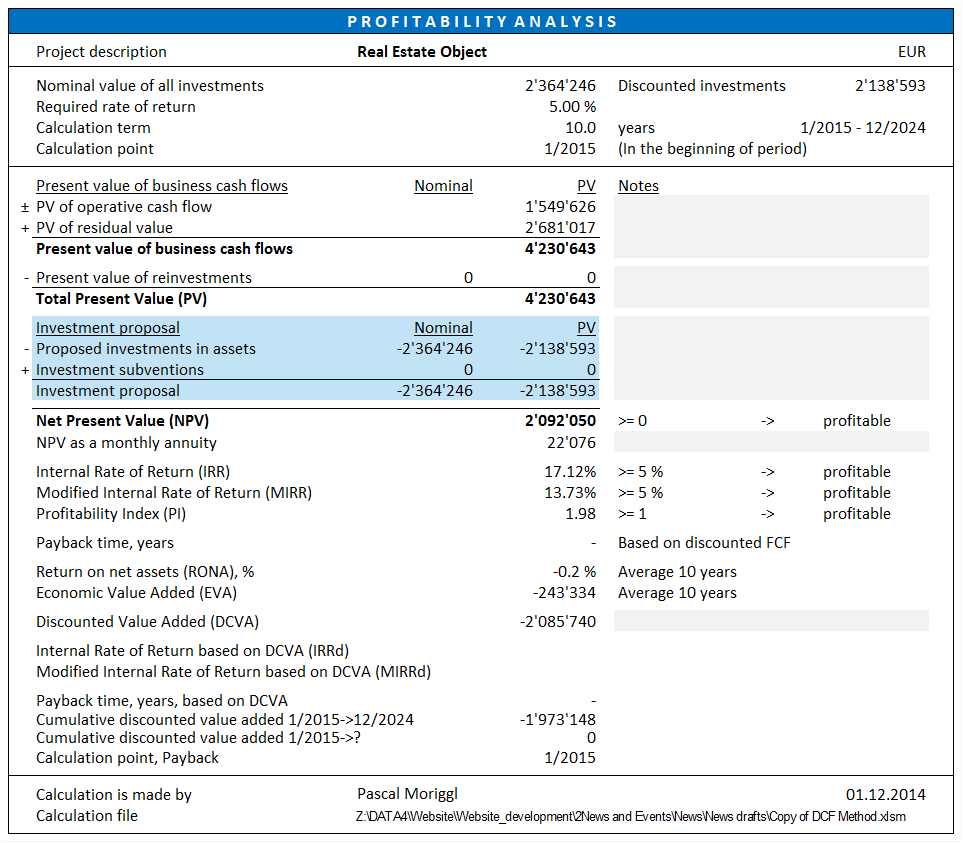

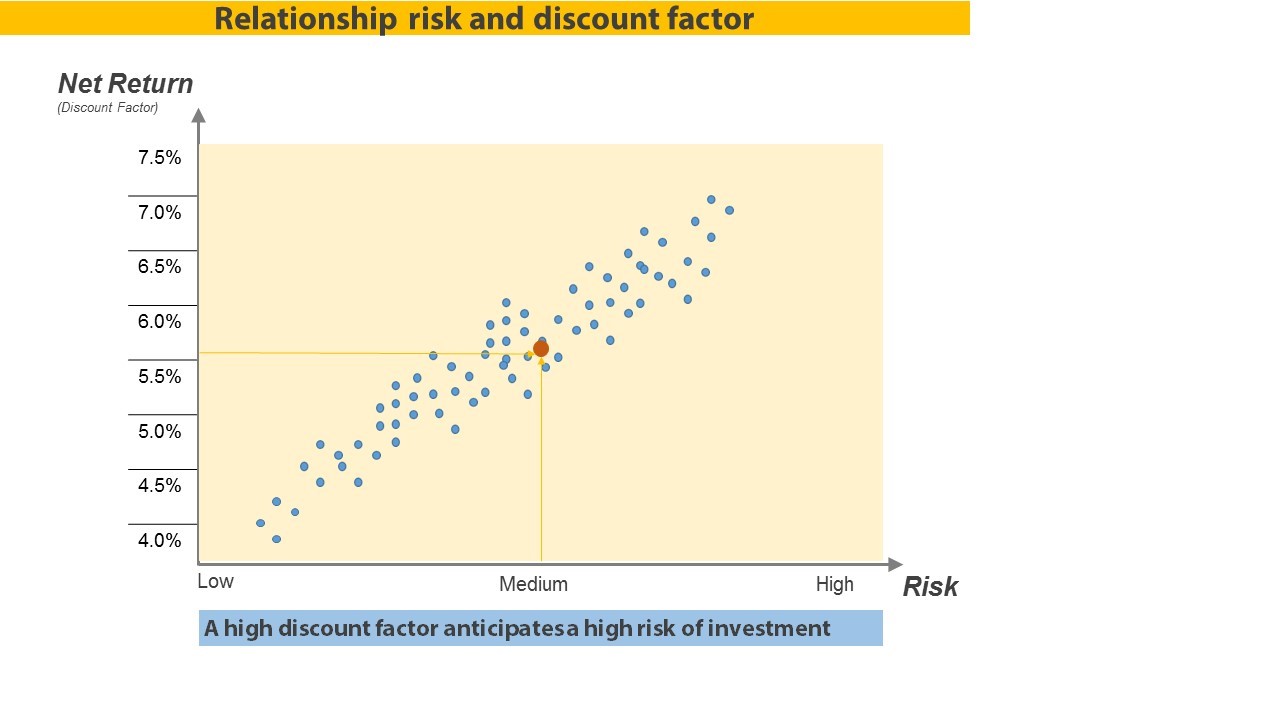

Risk-and Discount Factor

When evaluating the applicable discount factor, the risk level of the real estate object plays a crucial role. As with many investments, the higher risk an investment has, the higher the expected return should be. A high discount factor in real estate calculations lowers the present market value of an object, and a low discount factor values the future cash flow much higher (leverage), therefore it leads to a higher current calculated market value. The following diagram shows a plot of the mechanism between discount factor and market risk allocation:

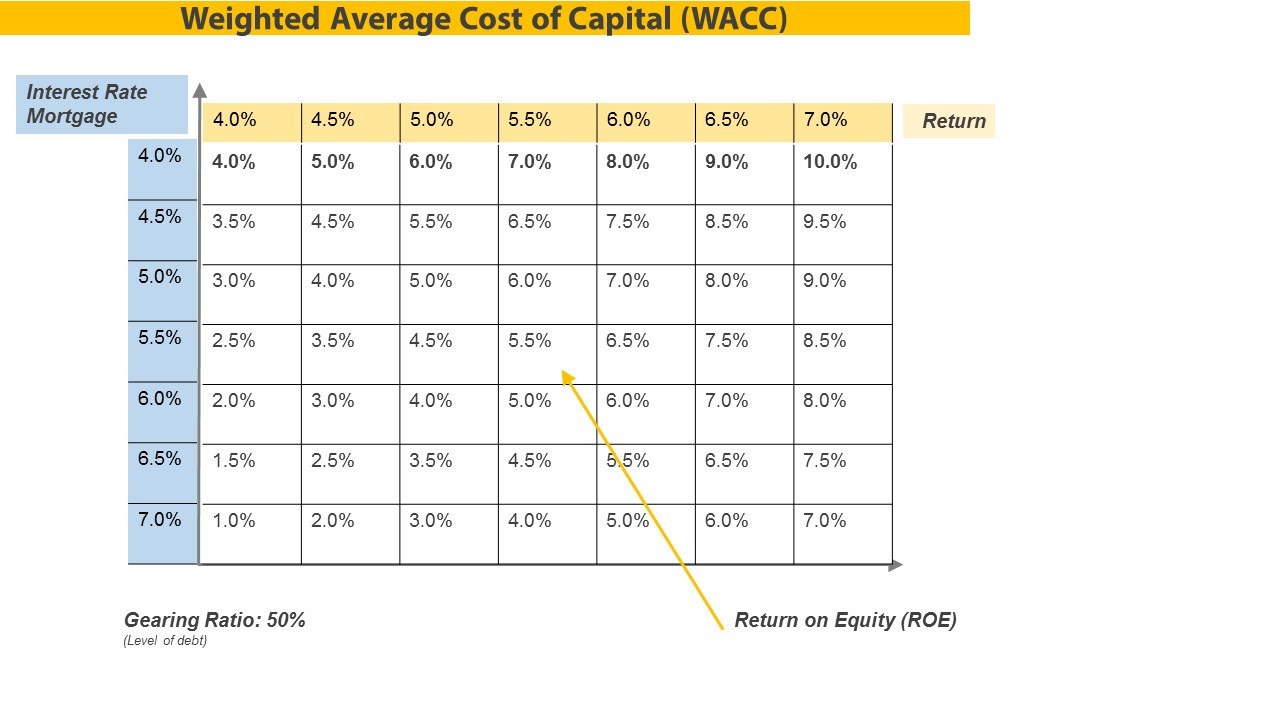

For calculating the discount factor, one can also apply the Weighted Average Cost of Capital formula. Below is a mathematical comparison of the mortgage interest rates, the applied rate of return and the resulting Return on Equity (ROE). This example table uses a gearing ratio of 50%, having only half of the investment leveraged.

Comment on the DCF-method for real estate valuations

A real estate valuation based on the DCF-method offers a transparent approach of modelling expected future income-, costs and risks. The method applies a risk-adjusted view on risk, performance and return. One can also develop scenarios to compare different situations and the resulting outcomes, compare them and based on that make the best possible decision. In the calculation file, an investor can also add expected value enhancement and renovation projects, which helps to model the overall investment. This can indicate upcoming challenges or bottlenecks at an early stage.

Once a DCF-valuation is created, it can also be used to compare different objects by this measurement, and manage a portfolio of real estate assets. Today, the increasing globalization also requires industry-wide standards across borders. The DCF-method is an established way with international recognition. It is also an important component in the framework of major accounting organizations worldwide. (US-GAAP, IFRS, etc.).