Foreword

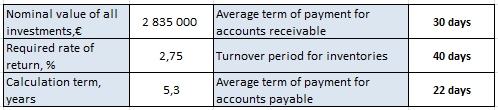

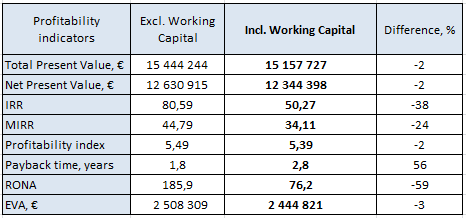

Sometimes it happens that treatment of working capital in financial modelling is unreasonably underestimated. Let’s take a look at impact of such conditions as average term of payment for accounts receivable/payable and turnover period for inventories. For that we calculated basic profitability indicators (see Picture 2) based on data (see Picture 1) which is partly represents initial data for an investment project.

Picture 1. Initial data

Picture 2. Impact of Working Capital on key profitability indicators

Simple example illustrated above shows that treatment of working capital has a significant impact in financial modelling and provides more realistic assessment of an investment project or a business. Besides, Invest for Excel® allows specification of working capital effects in just a couple of minutes. So, then the question arises: why not to use this Invest for Excel® capability for more accurate calculations that lead to more logical and reasonable decisions?

Working capital calculations – When is it needed?

The need of detailed treatment of working capital varies from project to project. In general it is determined by several factors, such as:

- Size of working capital required;

- Forecasted inflation rate;

- Level of uncertainty in supply of materials and payments from purchasers.

Working capital structure depends on the specificity of business processes. Thus, some projects require sophisticated calculations, while for others only the simplified estimates are enough. For instance, there are practically no purchased semi-finished goods in extractive industries; for companies in retail sector it is vital to have enough of stock of goods and inventory supplies, cash in the bank and in hand.

The working capital need is calculated differently for each particular project and requires detailed analysis in the initial stage of investment project planning.

Treatment of Working capital in Invest for Excel®

Invest for Excel® provides a structured approach to the treatment of Working capital.

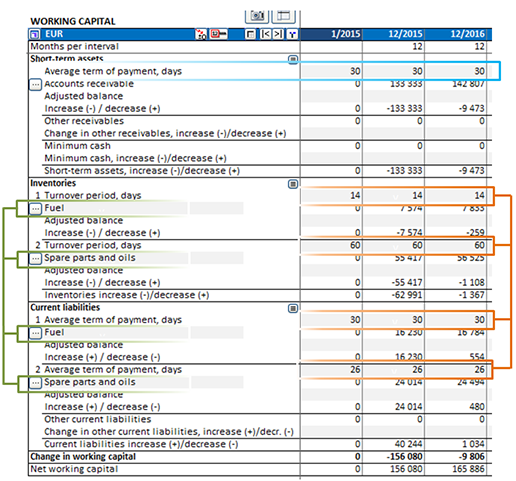

There are three main Working capital groups (see Picture 3):

- Short-term assets;

- Inventories;

- Current liabilities.

Each of the main Working capital groups can be specified in up to 5 sub-groups. It becomes very handy when you provide more precise estimation of your assets. Just by entering necessary values in prebuilt table you will receive a sought result in a fraction of a minute. Let’s see how it looks in Invest for Excel®:

Picture 3. Defining sub-groups. In our example illustrated above we estimate that each type of inventories (see green selection) has different turnover periods and average term of payment (see orange selection), whereas we expect to receive payments in period of 30 days which is fixed e.g. due to the agreement with our clientele (see blue selection).